The Magic Annuity

Outperforming Mutual Funds For Over 20 years, Risk-Free

Outperform Mutual Funds

It might help to define the MAGIC ANNUITY further. It’s called a Fixed Indexed Annuity (FIA) otherwise less known as an Equity Indexed Annuity (EIA).

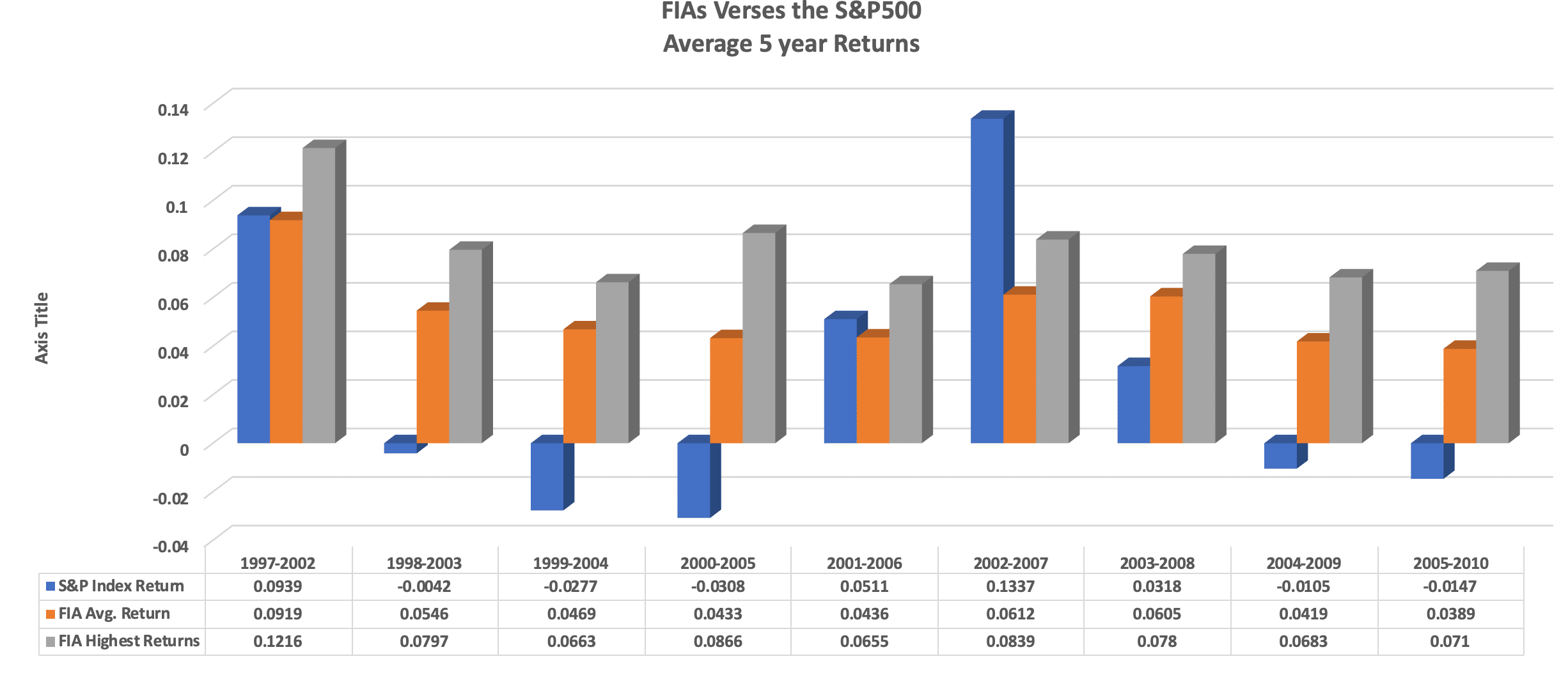

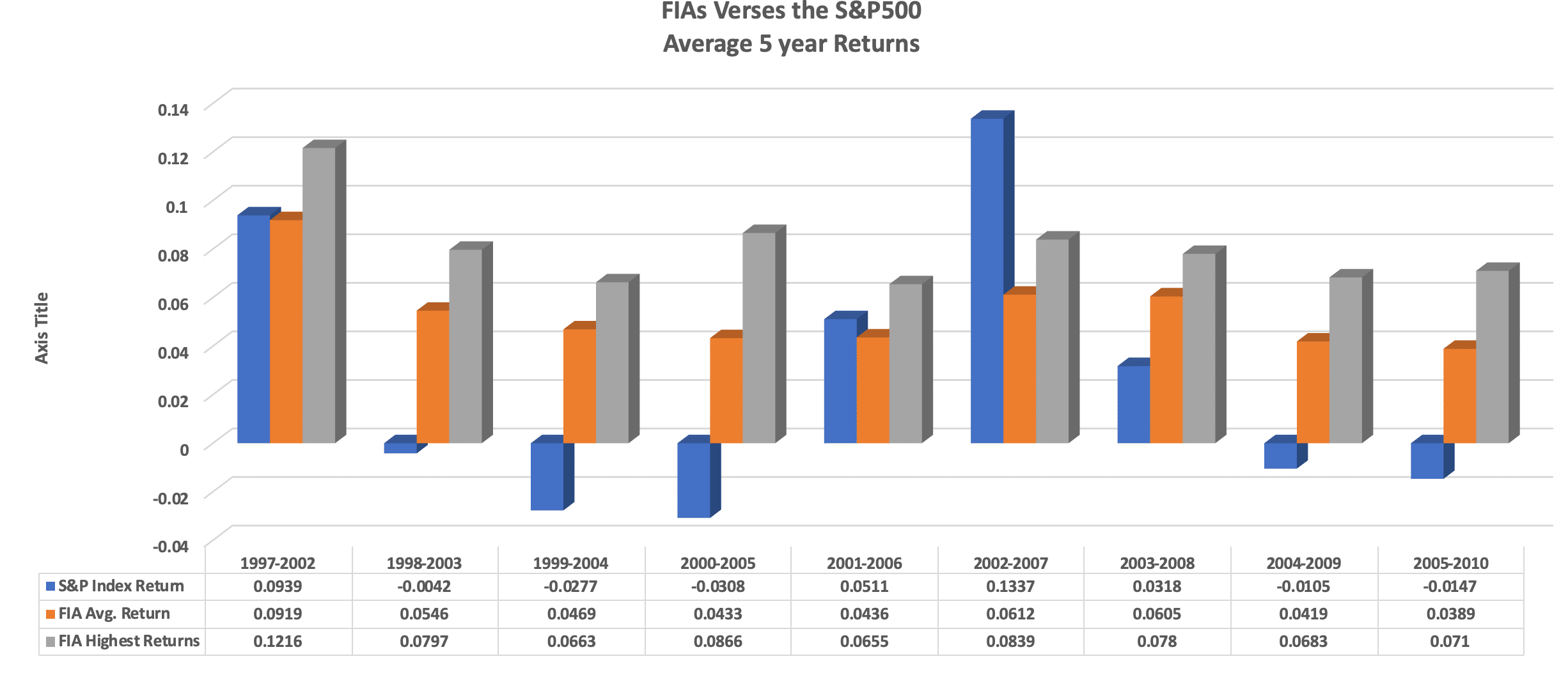

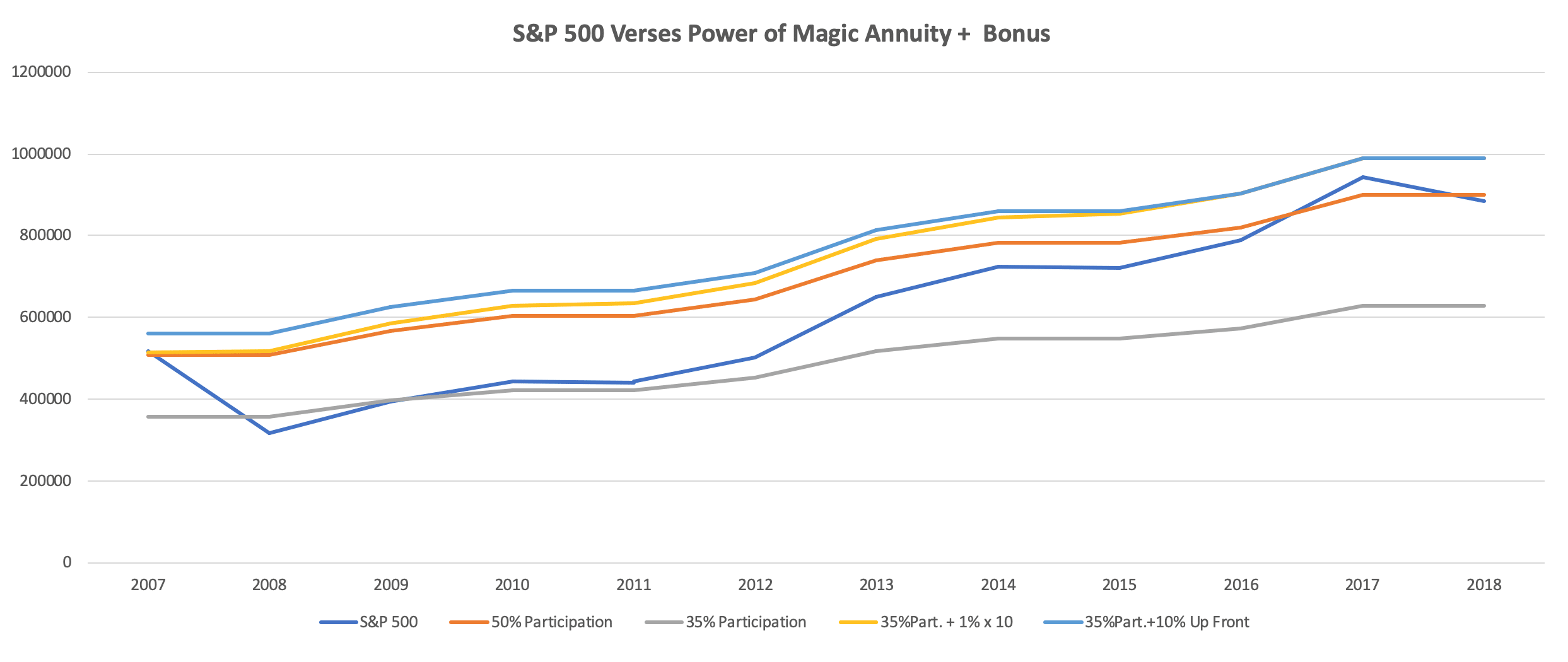

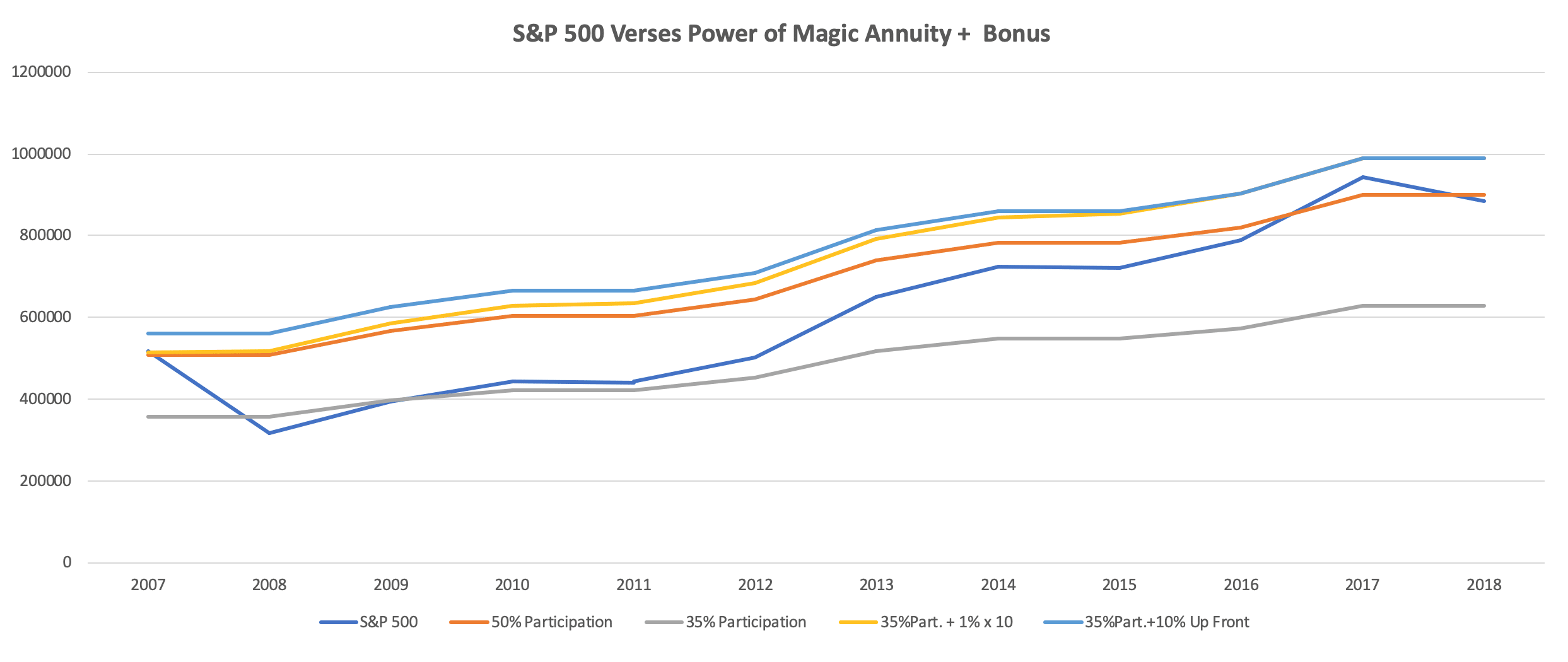

So, what kind of returns can we expect in an FIA? Before we look at the chart below, realize that these investment vehicles are just as varied as Mutual Funds and have many options, CAPS, and bonus structures to consider. Focus on the average returns as well as the highest returns, and notice some FIAs are out-performing others, but on the whole, they match or better the Mutual Fund returns without the risk.

It is important to note that the S&P had positive returns some years and negative returns in other years. While the FIA ALWAYS MADE POSITIVE RETURNS. The accumulation of only positive returns, no matter how small, has an overall cumulative effect on the portfolio.

NEVER LOSE PRINCIPAL

It might help to define the MAGIC ANNUITY further. It’s called a Fixed Indexed Annuity (FIA) otherwise less known as an Equity Indexed Annuity (EIA).

So, what kind of returns can we expect in an FIA? Before we look at the chart below, realize that these investment vehicles are just as varied as Mutual Funds and have many options, CAPS, and bonus structures to consider. Focus on the average returns as well as the highest returns, and notice some FIAs are out-performing others, but on the whole, they match or better the Mutual Fund returns without the risk.

It is important to note that the S&P had positive returns some years and negative returns in other years. While the FIA ALWAYS MADE POSITIVE RETURNS. The accumulation of only positive returns, no matter how small, has an overall cumulative effect on the portfolio.

PAY NO FEES

The Magic Annuity has no Fees. Conversely, the Variable Annuity, which I call the Voodoo annuity, and its Uncle, Mutual Funds have:

- 12b1 Fees – Funds charge these to pay for their marketing expenses and they can be as high as 1.5% of Assets.

- Assets Under Management Fees (AUM) – Fees charged by your Investment Advisor which can be as high as 2% of your account balance.

- Money Management Fees – those fees passed onto you by your Advisor who is using an outside service to “manage” the portfolio, usually around .25 to .50%.

- Taxes – if your investment in a Mutual Fund is not in a qualified retirement plan (403b,401K,457b,IRA) you could be getting taxed annually on any and all trades within the fund in which you made a profit (25 to 35% of gains).

Look at this chart. It’s an example of a 5% Bonus MAGIC ANNUITY with a super long Surrender Penalty Period (10 years) and a 10% Commission, compared to an example of a 1% Assets Under Management FEE structure in a Mutual Fund or Voodoo Annuity. Over 15 years one would accumulate 15% in FEES compared to ZERO FEES and ZERO surrender penalties after 10 years in the MAGIC Annuity. Keep in mind the surrender charge which decreases over time is NEVER taken out of your account unless you liquidate early. You can see even if you liquidated after five years, you’re at break even with the fund fees, except for the BONUS YOU RECEIVED in the MAGIC ANNUITY!

It might help to define the MAGIC ANNUITY further. It’s called a Fixed Indexed Annuity (FIA) otherwise less known as an Equity Indexed Annuity (EIA).

So, what kind of returns can we expect in an FIA? Before we look at the chart below, realize that these investment vehicles are just as varied as Mutual Funds and have many options, CAPS, and bonus structures to consider. Focus on the average returns as well as the highest returns, and notice some FIAs are out-performing others, but on the whole, they match or better the Mutual Fund returns without the risk.

It is important to note that the S&P had positive returns some years and negative returns in other years. While the FIA ALWAYS MADE POSITIVE RETURNS. The accumulation of only positive returns, no matter how small, has an overall cumulative effect on the portfolio.

It might help to define the MAGIC ANNUITY further. It’s called a Fixed Indexed Annuity (FIA) otherwise less known as an Equity Indexed Annuity (EIA).

So, what kind of returns can we expect in an FIA? Before we look at the chart below, realize that these investment vehicles are just as varied as Mutual Funds and have many options, CAPS, and bonus structures to consider. Focus on the average returns as well as the highest returns, and notice some FIAs are out-performing others, but on the whole, they match or better the Mutual Fund returns without the risk.

It is important to note that the S&P had positive returns some years and negative returns in other years. While the FIA ALWAYS MADE POSITIVE RETURNS. The accumulation of only positive returns, no matter how small, has an overall cumulative effect on the portfolio.

The Magic Annuity has no Fees. Conversely, the Variable Annuity, which I call the Voodoo annuity, and its Uncle, Mutual Funds have:

- 12b1 Fees – Funds charge these to pay for their marketing expenses and they can be as high as 1.5% of Assets.

- Assets Under Management Fees (AUM) – Fees charged by your Investment Advisor which can be as high as 2% of your account balance.

- Money Management Fees – those fees passed onto you by your Advisor who is using an outside service to “manage” the portfolio, usually around .25 to .50%.

- Taxes – if your investment in a Mutual Fund is not in a qualified retirement plan (403b,401K,457b,IRA) you could be getting taxed annually on any and all trades within the fund in which you made a profit (25 to 35% of gains).

Look at this chart. It’s an example of a 5% Bonus MAGIC ANNUITY with a super long Surrender Penalty Period (10 years) and a 10% Commission, compared to an example of a 1% Assets Under Management FEE structure in a Mutual Fund or Voodoo Annuity. Over 15 years one would accumulate 15% in FEES compared to ZERO FEES and ZERO surrender penalties after 10 years in the MAGIC Annuity. Keep in mind the surrender charge which decreases over time is NEVER taken out of your account unless you liquidate early. You can see even if you liquidated after five years, you’re at break even with the fund fees, except for the BONUS YOU RECEIVED in the MAGIC ANNUITY!

5% TO 10% UPFRONT BONUS

The Magic Annuity often offers BONUSES when you make your initial deposit. Yep, sometimes as high as 10% (if you’re 52 or younger, or 5 to 7% if older)! Imagine, you invest $100,000 in the Magic Annuity, and your first statement shows an accumulation value of $110,000!!! Wow you just made 10% return and all you did was make the initial investment! Now it’s not always 10% maybe its 5%, but that isn’t a kick in the head either!

So, let’s say the Advisor in this case made a 7% commission on your $100,000 investment. The next day your account is credited with an opening balance of $110,000. Hmmmmmm. Would you consider staying with this investment for 5 to 10 years, after which all or most of your penalties disappear? Remember, you have penalty free access, if you need it.

PENALTY FREE ACCESS

The Insurance Company, just like the Mutual Fund Provider or Bank, shares with you in the upside of the market returns. The difference with the MAGIC ANNUITY is that the Insurance Company GUARANTEES your principal investment, pays the up-front commission out of their own pocket, and must wait, often up to 7 years or longer, to get any return on their investment (ROI). In exchange, they require you to stay in the contract long enough for them to recoup their costs and be able to make some return on their investment. During the entire time you’re in the contract they never extract a dime out of your account and continue to credit all returns based on 100% (sometimes more) of your principal. Even if you did need some of your money early, you have so many options like:

- 10% (sometimes more) Penalty Free Withdrawals

- Borrow money out (must qualify)

- Annuitize (select one of usually a dozen options to start receiving pension payments, like guaranteed income for life option or many others)

- Hardships requests

TAX FAVORED

The Magic Annuity isTAX-FAVORED, meaning it gives you tax advantages and lets you manage how and when you pay taxes; and For over 20 years, the typical Magic Annuity has outperformed the typical Mutual Funds investor (and thus Variable Annuities) in average returns.

Inside most Mutual Funds and Variable Annuities Tax Benefits don’t always outweigh the FEES such as the infamous 12b1 expenses which can be as high as 1.5%. Additionally, if these investments were made inside a tax-deferred account like a 401(k), 403(b), 457 (b) or IRA, about 25%-33% on average in income taxes will have to be paid, according to the Center for Retirement Research at Boston College.

The Magic Annuity often offers BONUSES when you make your initial deposit. Yep, sometimes as high as 10% (if you’re 52 or younger, or 5 to 7% if older)! Imagine, you invest $100,000 in the Magic Annuity, and your first statement shows an accumulation value of $110,000!!! Wow you just made 10% return and all you did was make the initial investment! Now it’s not always 10% maybe its 5%, but that isn’t a kick in the head either!

So, let’s say the Advisor in this case made a 7% commission on your $100,000 investment. The next day your account is credited with an opening balance of $110,000. Hmmmmmm. Would you consider staying with this investment for 5 to 10 years, after which all or most of your penalties disappear? Remember, you have penalty free access, if you need it.

The Insurance Company, just like the Mutual Fund Provider or Bank, shares with you in the upside of the market returns. The difference with the MAGIC ANNUITY is that the Insurance Company GUARANTEES your principal investment, pays the up-front commission out of their own pocket, and must wait, often up to 7 years or longer, to get any return on their investment (ROI). In exchange, they require you to stay in the contract long enough for them to recoup their costs and be able to make some return on their investment. During the entire time you’re in the contract they never extract a dime out of your account and continue to credit all returns based on 100% (sometimes more) of your principal. Even if you did need some of your money early, you have so many options like:

- 10% (sometimes more) Penalty Free Withdrawals

- Borrow money out (must qualify)

- Annuitize (select one of usually a dozen options to start receiving pension payments, like guaranteed income for life option or many others)

- Hardships requests

The Magic Annuity isTAX-FAVORED, meaning it gives you tax advantages and lets you manage how and when you pay taxes; and For over 20 years, the typical Magic Annuity has outperformed the typical Mutual Funds investor (and thus Variable Annuities) in average returns.

Inside most Mutual Funds and Variable Annuities Tax Benefits don’t always outweigh the FEES such as the infamous 12b1 expenses which can be as high as 1.5%. Additionally, if these investments were made inside a tax-deferred account like a 401(k), 403(b), 457 (b) or IRA, about 25%-33% on average in income taxes will have to be paid, according to the Center for Retirement Research at Boston College.

CUSTOM DESIGN

The MAGIC ANNUITY, aka Fixed Index Annuity, is a viable safe alternative to Mutual Fund and Variable Annuity investing! There simply is no reason to RISK your principal for so little upside. Alternatively, if you are investing with RISK you should be receiving a much higher rate of return.

Here you can see the S&P 500 (2007 – 2018) compared against an FIA that only participates in 50% of market gains, BUT None of the losses. Notice the 50% participation FIA pretty much matches the S&P over time.

HUNDREDS OF PRODUCTS

-

AIG

-

AIG Retirement Services

-

American Century Investments

-

American Fidelity Assurance Company

-

American Funds Distributors, Inc. (AFD)

-

American United Life (AUL), a OneAmerica Financial Partner

-

Americo Financial Life and Annuity Insurance Company/Great Southern Life Insurance Company

-

Ameriprise Financial Inc.

-

Athene Annuity and Life Company

-

AXA Distributors, LLC

-

AXA Equitable Life Insurance Company

-

Brighthouse Financial

-

CalSTRS Pension2

-

CTA Voluntary Retirement Plans for Educators, LLC

-

Empower Retirement

-

Fidelity

-

Fidelity Investments

-

First Investors Funds distributed by Foresters Financial

-

Franklin Templeton Investments

-

FTJ FundChoice, LLC

-

Global Atlantic Financial Group

-

GLP Investment Services, LLC

-

Great American Insurance Group (Annuity Investors Life Insurance Company)

-

GWN Securities, Inc

-

Horace Mann Investors, Inc.

-

Horace Mann Life Insurance Company

-

ICMA-RC

-

Industrial-Alliance Pacific Life Ins Co, US Branch

-

Invesco (formerly OppenheimerFunds)

-

Jackson National Life Ins. Co.

-

Lincoln Investment, LLC

-

Lincoln Nat'l Life Ins Co (Lincoln Financial Group), The

-

MassMutual, through its subsidiary, C.M. Life Insurance Co.

-

Metlife

-

Metropolitan Life Insurance Company

-

Midland National

-

Modern Woodmen of America

-

National Life Group through member company Life Insurance Company of the Southwest

-

Nationwide Life Insurance Company

-

New York Life Ins. & Annuity Corp.

-

North American Company for Life and Health

-

Pacific Life Insurance Company

-

PFS Investments Inc

-

PlanMember Services Corp

-

Putnam Investments

-

RBB Funds Inc.

-

Security Benefit

-

Thrivent Financial AKA Thrivent Financial for Lutherans, Thrivent Mutual Funds

-

TIAA

-

Transamerica

-

Transamerica Fund Services, Inc.

-

Transamerica Life Insurance Company

-

USAA Investment Management Company

-

USAA Life Insurance Company

-

Vanguard

-

Vanguard Group, The

-

Voya - ReliaStar Life Insurance Company

-

Voya Retirement Insurance and Annuity Company

-

Waddell & Reed, Inc

-

Western National Life Insurance Company

WHO ARE WE?

My name is Robert Lotter. I am the founder of the Financial and Health Research Institute. In my 40 years of being in the financial services business, my firms have served over 1,000,000 public and private employees. Our specialty has always been retirement savings benefits, specifically 403b, 457b, 401k and IRAs. One of my firms is the oldest and largest Third Party Administrator for retirement benefits in the state of California. Because of this, we have service agreements with about 50 or so large financial institutions from Allianz Insurance Company to Vanguard Mutual Funds. We literally handle the remittance of funds from the employer on behalf of thousands of their employees, directly into these retirement savings program. Few people in this country have this kind of access and awareness about the myriad of financial choices available today. These include everything from Exchange Trade Funds, Mutual Funds, Managed Accounts, Variable Annuities and Fixed Annuities. While it is important to have a financial advisor, few are experts on as many product offerings. I encourage you to sign up for a free, no obligation, risk analysis of your retirement investment portfolio. Ask one of our advisors for an official illustration of a MAGIC Annuity, which will project not only your return on investment possibilities, but also a myriad of other benefits. I promise you it wont be a waste of time and everything can be done over the phone and internet! Wishing you the peace of mind that ONLY a guaranteed investment can provide!

The MAGIC ANNUITY, aka Fixed Index Annuity, is a viable safe alternative to Mutual Fund and Variable Annuity investing! There simply is no reason to RISK your principal for so little upside. Alternatively, if you are investing with RISK you should be receiving a much higher rate of return.

Here you can see the S&P 500 (2007 – 2018) compared against an FIA that only participates in 50% of market gains, BUT None of the losses. Notice the 50% participation FIA pretty much matches the S&P over time.

-

AIG

-

AIG Retirement Services

-

American Century Investments

-

American Fidelity Assurance Company

-

American Funds Distributors, Inc. (AFD)

-

American United Life (AUL), a OneAmerica Financial Partner

-

Americo Financial Life and Annuity Insurance Company/Great Southern Life Insurance Company

-

Ameriprise Financial Inc.

-

Athene Annuity and Life Company

-

AXA Distributors, LLC

-

AXA Equitable Life Insurance Company

-

Brighthouse Financial

-

CalSTRS Pension2

-

CTA Voluntary Retirement Plans for Educators, LLC

-

Empower Retirement

-

Fidelity

-

Fidelity Investments

-

First Investors Funds distributed by Foresters Financial

-

Franklin Templeton Investments

-

FTJ FundChoice, LLC

-

Global Atlantic Financial Group

-

GLP Investment Services, LLC

-

Great American Insurance Group (Annuity Investors Life Insurance Company)

-

GWN Securities, Inc

-

Horace Mann Investors, Inc.

-

Horace Mann Life Insurance Company

-

ICMA-RC

-

Industrial-Alliance Pacific Life Ins Co, US Branch

-

Invesco (formerly OppenheimerFunds)

-

Jackson National Life Ins. Co.

-

Lincoln Investment, LLC

-

Lincoln Nat'l Life Ins Co (Lincoln Financial Group), The

-

MassMutual, through its subsidiary, C.M. Life Insurance Co.

-

Metlife

-

Metropolitan Life Insurance Company

-

Midland National

-

Modern Woodmen of America

-

National Life Group through member company Life Insurance Company of the Southwest

-

Nationwide Life Insurance Company

-

New York Life Ins. & Annuity Corp.

-

North American Company for Life and Health

-

Pacific Life Insurance Company

-

PFS Investments Inc

-

PlanMember Services Corp

-

Putnam Investments

-

RBB Funds Inc.

-

Security Benefit

-

Thrivent Financial AKA Thrivent Financial for Lutherans, Thrivent Mutual Funds

-

TIAA

-

Transamerica

-

Transamerica Fund Services, Inc.

-

Transamerica Life Insurance Company

-

USAA Investment Management Company

-

USAA Life Insurance Company

-

Vanguard

-

Vanguard Group, The

-

Voya - ReliaStar Life Insurance Company

-

Voya Retirement Insurance and Annuity Company

-

Waddell & Reed, Inc

-

Western National Life Insurance Company

My name is Robert Lotter. I am the founder of the Financial and Health Research Institute. In my 40 years of being in the financial services business, my firms have served over 1,000,000 public and private employees. Our specialty has always been retirement savings benefits, specifically 403b, 457b, 401k and IRAs. One of my firms is the oldest and largest Third Party Administrator for retirement benefits in the state of California. Because of this, we have service agreements with about 50 or so large financial institutions from Allianz Insurance Company to Vanguard Mutual Funds. We literally handle the remittance of funds from the employer on behalf of thousands of their employees, directly into these retirement savings program. Few people in this country have this kind of access and awareness about the myriad of financial choices available today. These include everything from Exchange Trade Funds, Mutual Funds, Managed Accounts, Variable Annuities and Fixed Annuities. While it is important to have a financial advisor, few are experts on as many product offerings. I encourage you to sign up for a free, no obligation, risk analysis of your retirement investment portfolio. Ask one of our advisors for an official illustration of a MAGIC Annuity, which will project not only your return on investment possibilities, but also a myriad of other benefits. I promise you it wont be a waste of time and everything can be done over the phone and internet! Wishing you the peace of mind that ONLY a guaranteed investment can provide!

“The mutual fund industry is now the world’s largest skimming operation, a $7 trillion (now over $20 trillion) trough from which fund managers, brokers, and other insiders are steadily siphoning off an excessive slice of the nation’s household, college, and retirement savings.”

– Senator Peter Fitzgerald

Former Chairman of the Senate Subcommittee on Financial Management

Don’t Believe The Hype About Mutual Funds!

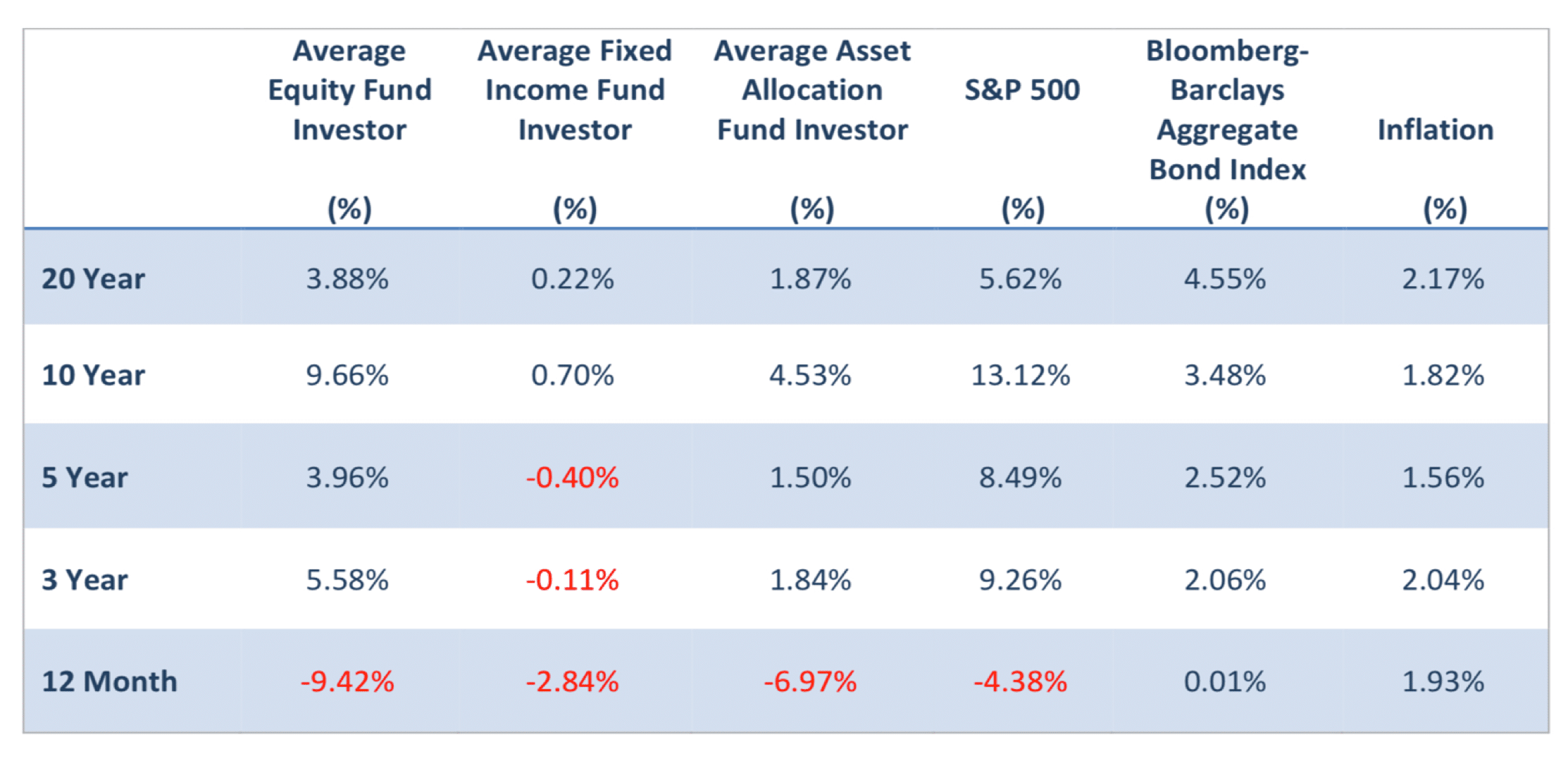

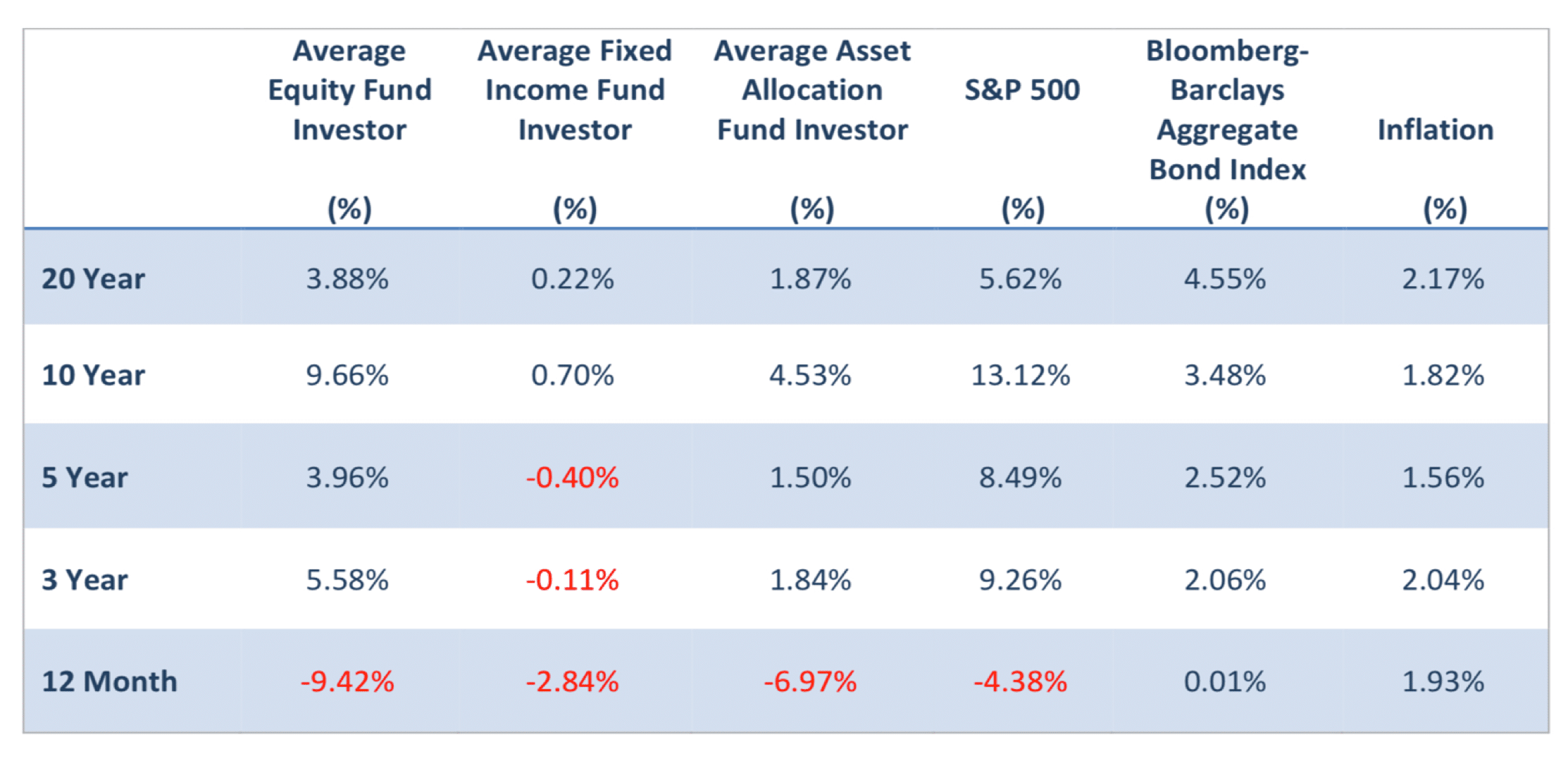

According to a new study by DALBAR, the financial community’s leading independent expert for unbiased ratings and performance evaluations, the typical investor in equity mutual funds has gotten only a 3.88% annual return… over the last 20 years! The average investor in asset allocation mutual funds (which spread your money among a variety of classes) earned only 1.87% per year

Quantitative Analysis of Investor Behavior report by DALBAR, 20-year period ending December 31, 2018.

Stop Paying Fees!

12b1 Fees, as high as 1.5%, Assets Under management Fees as high as 2%, Money Management Fees another .25 to .5% ZERO FEES = Higher Returns

Competitive Returns

Better financial results than Mutual Funds with NO RISK TO PRINCIPAL AND EARNINGS! It’s even possible to beat the market over time with the right MAGIC Annuity strategy.

Customers Love the RISK-FREE MAGIC Annuity

“Finally, an investment that doesn’t risk my principal!”

“Now going forward I have the confidence knowing that when I need my retirement funds, they will be there.”

About FHRI

The Financial Health Research Institute offers FREE financial tools and services to empower you to make informed financial decisions.